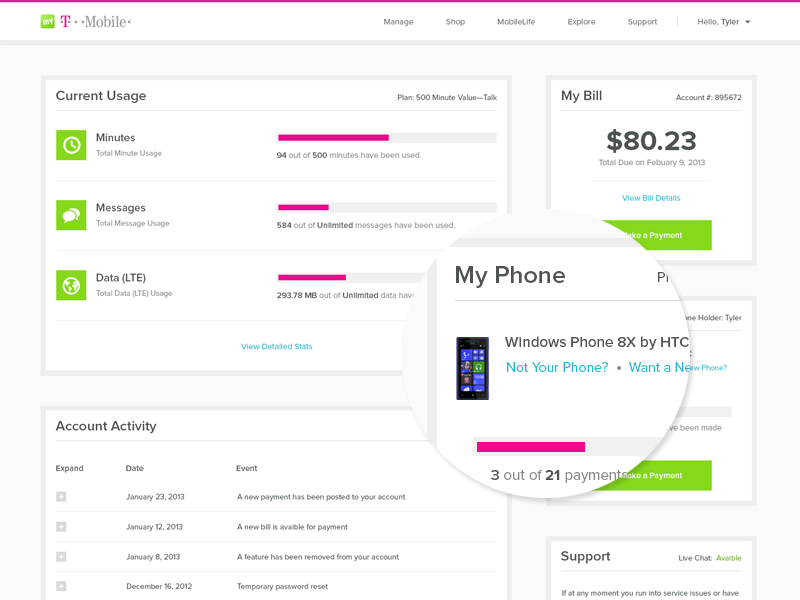

T Mobile Savings Account

Please turn on JavaScript in your browser

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

How APY works: As a T-Mobile MONEY customer you earn 4.00% annual percentage yield (APY) on balances up to and including $3,000 in your Checking Account per month when: 1) you are enrolled in a qualifying T-Mobile postpaid wireless plan; 2) you have registered for perks with your T-Mobile ID; and 3) As of today: at least $200 in qualifying deposits have posted to your Checking Account. I've been contemplating opening an account with T-Mobile Money, but I haven't been able to find much in the way of opinions or experience. For context, T-Mobile Money is a program partnered with BankMobile, a Division of Customers Bank, is offering 4% APY on a checking account for balances of up to $3k ($120/yr in interest). So, before I had established an account with t-mobile, a representative from t-mobile specifically told me that the credit check would be a SOFT PULL and NOT a HARD PULL. So i agreed to have them pull my. With T-Mobile you’ll save up to 20% every month on average with 2+ lines vs. AT&T and Verizon when you take advantage of all the benefits that come with your device.

Savings made simple with Chase Savings℠

This account makes it easy to start saving. You’ll have access to chase.com and our mobile banking tools.

Benefits of Chase Savings℠

- Earns interest. See interest rates.

- Automatic Savings Program

- Online and mobile banking

- Account Alerts

- Access to 16,000 ATMs and more than 4,700 branches

- FDIC insurance protection

Account details include:

- $5 monthly service fee or $0 with one of the following, each monthly statement period:

- A balance at the beginning of each day of $300 or more in this account

- OR $25 or more in total Autosave or other repeating automatic transfers from your personal Chase checking account (available only through chase.com or Chase Mobile®)

- OR a Chase College Checking℠ account linked to this account for Overdraft Protection

- OR an account owner who is an individual younger than 18

- OR a linked Chase Better Banking® Checking, Chase Premier Checking℠, Chase Premier Plus Checking℠, Chase Sapphire℠ Checking, or Chase Private Client Checking℠ account

Savings Withdrawal Limit Fee: $5 Savings Withdrawal Limit Fee, which is a Chase fee, applies to each withdrawal or transfer out of this account over six per monthly statement period. All withdrawals and transfers out of this account count toward this fee, including those made at a branch or at an ATM.

Other miscellaneous fees apply.

See Account Disclosures and Rates for more information. Account subject to approval.

BeginningTools to help you bank on your terms.

Direct Deposit

Most convenient way to automatically deposit your checks each payday.

Chase QuickDeposit℠

Just point and click to deposit checks from almost anywhere, anytime.

Online Bill Pay

Make payments securely at chase.com or with your mobile device.

Chase QuickPay® with Zelle®

Easily send money to another person without cash or checks.

Paperless Statements

Access up to 7 years of statements online or on your mobile device.

Account Alerts

Monitor your finances to help avoid overdrafts and safeguard your account.

Text Banking

Check balances and transaction history on the go by simply sending a text.

T Mobile Savings Account Review

End

EndFind the right savings account for you

- Chase Certificates of Deposit

- Chase Premier Savings℠

Find a Chase ATM or branch

To find a Chase ATM or branch near you, tell us a ZIP code or an address.

Additional assistance

T Mobile 4% Savings Account

- See exclusive Chase Private Client products

- Learn about Chase Military Banking for servicemembers

We believe in delivering the perfect client experience and place the highest priority on protecting your confidential information. For security purposes, we have temporarily suspended online access to your account.

To access your account, please:

- Visit a BB&T branch or ATM

- Log in to the U by BB&T® mobile app

- Send a text to MYBBT (69228) (if you have a mobile number registered with BB&T)

- Call our online banking support at 888-228-6654 and provide us the reference code below

Reference Code: (18.e4b2f748.1615063387.8732c37)

Thank you for your patience, and please accept our apologies for any inconvenience this may have caused.