Safe Deposit

A safe deposit box is a secure container usually made of metal that’s used to store valuables at a bank or credit union. These boxes are often kept in vaults and can be rented throughout the.

- A safe deposit box (or safety deposit box) is an individually secured container—usually a metal box—that stays in the safe or vault of a federally insured bank or credit union. Safe deposit boxes.

- Safe Deposit Remote Cash Deposit Perfected. We are changing the game and removing the barriers and complexities inherent with bank provided remote cash deposit. 980-213-0133 info@safedeposit.company.

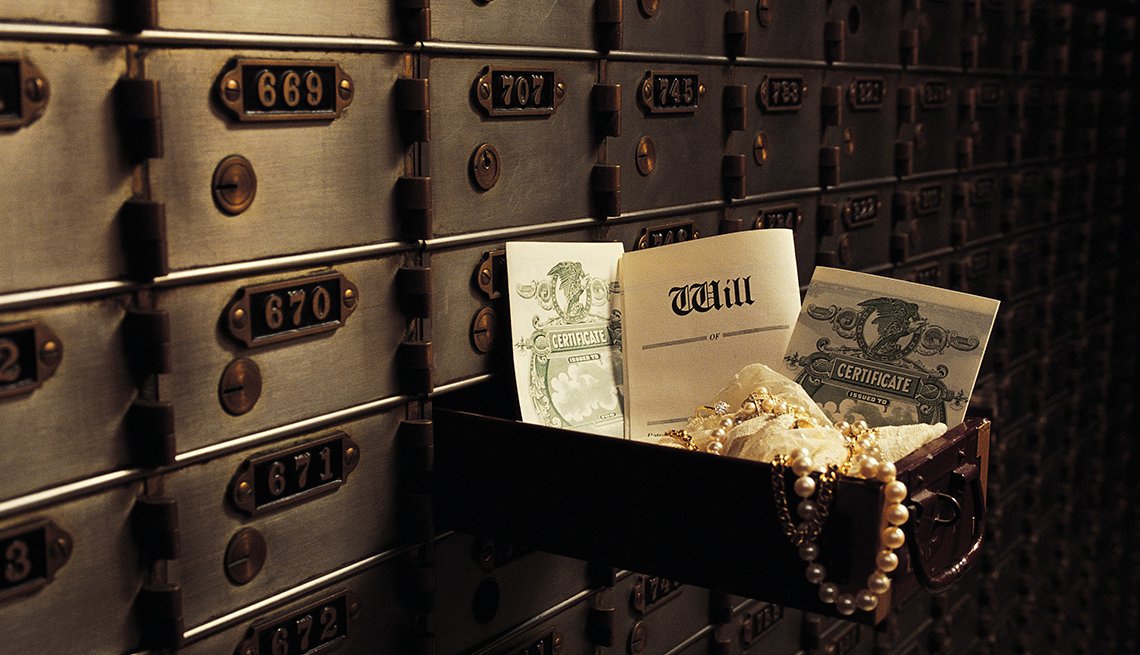

A safe deposit box, also known as a safety deposit box, is an individually secured container, usually held within a larger safe or bank vault. Safe deposit boxes are generally located in banks, post offices or other institutions. Safe deposit boxes are used to store valuable possessions, such as gemstones, precious metals, currency, marketable securities, luxury goods, important documents (e.g. wills, property deeds, or birth certificates), or computer data, which need protection from theft, fire, flood, tampering, or other perils. In the United States, neither banks nor the FDIC insure the contents. An individual can purchase separate insurance for the safe deposit box in order to cover e.g. theft, fire, flooding or terrorist attacks.

Hotels, resorts, and cruise ships sometimes also offer safe deposit boxes or small safes to their patrons, for temporary use during their stay.[1] These facilities may be located behind the reception desk, or securely anchored within private guest rooms for privacy.

The contents of safe deposit boxes may be seized under the legal theory of abandoned property.[2] They also may be searched and seized by the order of a court through the issuance of search warrant.[3]

In the United States and elsewhere, safe deposit boxes are considered a 'legacy service'; many new bank branches do not bother to install any.[4] In the 20th century, bank branches were more prestigious; in the 21st century, space has grown more valuable with higher land values and rents, and many banks see the service as ancillary to their core business. Additionally, despite the public perception of safe deposit boxes as being extremely secure, there is little incentive for banks to actually ensure this is true; there are no federal laws in the US governing the matter or rules that would require compensation to customers if property stored there is stolen or destroyed.[4]

See also[edit]

References[edit]

- ^Payne, Kirby D. Safety Deposit Boxes and In-Room Safes. Hotel Online data base of News and Trends.

- ^Liz Pulliam Weston. 'Why treasures in safe deposit boxes get 'lost''. MSN Money.

- ^'Search Warrants'(PDF). American Safe Deposit.

- ^ abSafe Deposit Boxes Aren't Safe

Safe Deposit Box Alternatives