Bank Deposit Interest Rates

Savings account and retail deposit rate. Bulk deposit rate – rates for = 2 crores (w.e.f. ) fcnr rates above 5 million. For those stashing cash, the average savings account rate is down to just 0.05%, or even less, at some of the largest retail banks, according to the Federal Deposit Insurance Corp.

- Bank Deposit Interest Rates Comparison

- Bank Deposit Interest Rates In Usa

- Bank Of America High Interest Account

- Interest Rates On Deposit Accounts

Bank Deposit Interest Rates Comparison

With this interest rates table, you can use the arrows to sort by various options such as interest rate, provider, amount and rating.

Rates changes from the past seven days will be highlighted in green or red.

Bank Deposit Interest Rates In Usa

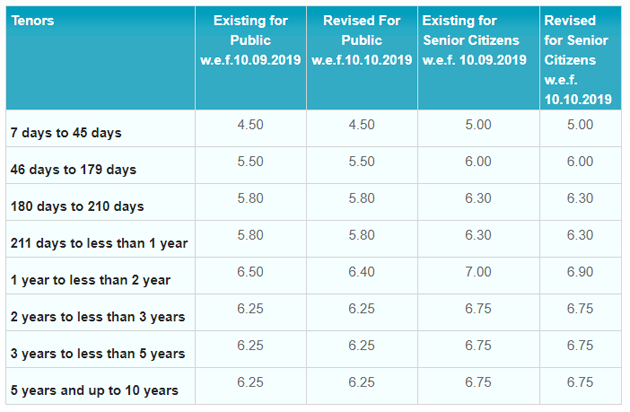

- Revision of interest rate on Term Deposits w.e.f The interest rate applicable for “Deposit/s of above ₹ 5 crore” and approval for acceptance of such deposit/s shall be obtained from Treasury Branch.

- Savings Bank Account interest is calculated on a daily basis on the daily closing balance in the Account, at the rate specified by ICICI Bank in accordance with Reserve Bank of India directives. The interest amount calculated is rounded off to the nearest rupee. With effect from March 30, 2016, interest.

Minimum Deposit 2: $500: $25,000: $50,000: $100,000: Term (mos.) Interest Rate: APY 3: Interest Rate: APY 3: Interest Rate: APY 3: Interest Rate: APY 3: 6: 0.12: 0.12.

NEW: Click on a provider's name or logo to see all their rates.

| All | Term Deposits | Call Accounts | Online Call Accounts | Savings | Debentures | Bonds | By Provider |

| Provider | Product | Minimum Deposit | Maximum Deposit | 30 days | 60 days | 90 days | 5 months | 6 months | 9 months | 12 months |

|---|---|---|---|---|---|---|---|---|---|---|

| ANZ | Term Deposits | $10,000 | - | 0.15 | 0.25 | 0.35 | 0.55 | 0.80 | 0.80 | 0.80 |

| Term Investment | $5,000 | $9,999 | 0.15 | 0.25 | 0.35 | 0.55 | 0.80 | 0.80▲ | 0.80▲ | |

| Term Investment | $10,000 | $49,999 | 0.15 | 0.25 | 0.35 | 0.55 | 0.80 | 0.80▲ | 0.80▲ | |

| Asset Finance | Term Deposit | $2,500 | - | - | - | - | - | - | 2.50 | 3.30 |

| BNZ | Term Investment | $2,000 | $5,000,000 | 0.15 | 0.25 | 0.35 | 0.55 | 0.80 | 0.80 | 0.80 |

| China Construction Bank | Term Deposit | $100,000 | $5,000,000 | - | - | - | - | - | - | - |

| Co-operative Bank | Term Deposit | $2,000 | - | 0.15 | - | 0.40 | - | 0.95 | 0.95 | 0.95 |

| Co-operative Bank | Special Term Deposit | $5,000 | - | - | - | - | - | 1.00 | - | 1.00 |

| Term Deposit | $1,000 | - | - | - | - | - | 1.30 | - | 2.30 | |

| First Credit Union | Term Investment | $500 | - | - | - | 0.75 | - | 1.10 | 1.15 | 1.20 |

| General Finance | Deposit Rate | $5,000 | $100,000 | - | - | - | - | 2.55 | 3.10 | 3.55 |

| Heartland Bank | Heartland Term Deposit | $1,000 | - | 0.15 | 0.25 | 0.40 | - | 0.90 | 0.90 | 1.00 |

| Heretaunga Building Society | Term Investment | $1 | - | - | - | 0.40▼ | - | 0.80▼ | - | 1.00 |

| HSBC Premier | Term Deposits | - | $9,999 | 0.05 | - | 0.05 | 0.10 | 0.10 | 0.10 | 0.10 |

| HSBC Premier | Term Deposit | $10,000 | $99,999 | 0.07 | - | 0.10 | 0.35 | 0.60 | 0.60 | 0.60 |

| HSBC Premier | Term Deposit | $100,000 | - | 0.10 | - | 0.35 | 0.55 | 0.80 | 0.80 | 0.80 |

| Kiwibank | Term Deposits | $1,000 | $4,999 | - | - | 0.25 | 0.25 | 0.50 | 0.50 | 0.50 |

| Kiwibank | Term Deposits | $5,000 | $9,999 | 0.05 | 0.15 | 0.25 | 0.50 | 0.80 | 0.70 | 0.90 |

| Kiwibank | Term Deposits | $10,000 | - | 0.15 | 0.25 | 0.35 | 0.60 | 0.90 | 0.80 | 1.00 |

| Kookmin - NZ | Term Deposit | $10,000 | $49,999 | 0.10 | 0.10 | 0.30 | 0.40 | 0.60 | 0.60 | 0.90 |

| Provider | Product | Minimum Deposit | Maximum Deposit | 30 days | 60 days | 90 days | 5 months | 6 months | 9 months | 12 months |

| Kookmin - NZ | Term Deposit | $50,000 | $99,999 | 0.10 | 0.10 | 0.30 | 0.50 | 0.70 | 0.70 | 1.00 |

| Kookmin - NZ | Term Deposit | $100,000 | - | 0.10 | 0.10 | 0.40 | 0.60 | 0.80 | 0.80 | 1.10 |

| Kookmin - NZ | Term Deposit | $5,000 | $9,999 | 0.10 | 0.10 | 0.30 | 0.30 | 0.50 | 0.50 | 0.80 |

| Term Deposit | $5,000 | $19,999 | - | - | 2.45 | - | 2.90 | 2.95 | 3.00 | |

| Term Deposit | $20,000 | $99,999 | - | - | 2.50 | - | 2.95 | 3.00 | 3.05 | |

| Term Deposit | $100,000 | - | - | - | 2.55 | - | 3.05 | 3.10 | 3.15 | |

| Napier Building Society | Term Deposit | $5,000 | - | - | - | - | - | - | - | - |

| Nelson Building Society | Term Deposit | $5,000 | $250,000 | 0.15 | - | 0.45 | - | 0.85 | 0.85 | 0.95 |

| NZCU Auckland | Investment Account | $500 | $9,999 | - | - | 0.60 | - | 1.05 | 1.05 | 1.10 |

| NZCU Auckland | Investment Account | $10,000 | $500,000 | - | - | 0.60 | - | 1.10 | 1.10 | 1.15 |

| NZCU Baywide | Term investment | $1,000 | $1,000,000 | 0.15 | 0.15 | 0.50 | 0.70 | 0.90 | 0.95 | 1.00 |

| NZCU South | Term investment | $1,000 | $500,000 | 0.15 | 0.15 | 0.50 | 0.70 | 0.90 | 0.95 | 1.00 |

| Public Trust | Term Deposit | $5,000 | $9,999 | - | - | 1.00 | - | 1.00 | 1.00 | 1.00 |

| Public Trust | Term Deposit | $10,000 | $49,999 | - | - | 1.00 | - | 1.00 | 1.00 | 1.00 |

| Public Trust | Term Deposit | $50,000 | $249,999 | - | - | 1.00 | - | 1.00 | 1.00 | 1.00 |

| Public Trust | Term Deposit | $250,000 | - | - | - | 1.00 | - | 1.00 | 1.00 | 1.00 |

| Rabobank Term Deposits | $1,000 | - | 0.20 | - | 0.25 | - | 1.00 | 1.00 | 1.00 | |

| SBS Bank | Term Investment Specials | $1,000 | $250,000 | - | - | 0.40 | 0.50 | 0.90 | 0.90 | 1.00 |

| Term Deposit | $5,000 | $9,999 | 0.05 | 0.10 | 0.25 | 0.45 | 0.70 | 0.70 | 0.70 | |

| Term Deposit | $10,000 | $250,000 | 0.15 | 0.25 | 0.35 | 0.55 | 0.80 | 0.80 | 0.80 | |

| Provider | Product | Minimum Deposit | Maximum Deposit | 30 days | 60 days | 90 days | 5 months | 6 months | 9 months | 12 months |

| Wairarapa Bldg Socy | Term Investment | $500 | $1,999 | - | - | 0.45 | - | 0.45 | 0.45 | 0.45 |

| Wairarapa Bldg Socy | Term Investment | $2,000 | $4,999 | - | - | 0.45 | - | 0.65 | 0.70 | 0.75 |

| Wairarapa Bldg Socy | Term Investment | $5,000 | - | - | - | 0.50 | - | 0.95 | 1.00 | 1.05 |

| Term Investment | $5,000 | $5,000,000 | 0.15 | 0.20 | 0.35 | 0.55 | 0.80 | 0.80 | 0.80 |

Central Bank Disclosure of Deposit Yields & Rates

Bank Of America High Interest Account

Effective Dates: March 1, 2021 – March 9, 2021

Interest Rates On Deposit Accounts

Type | Name | APY* | Interest Rate | Minimum Balance to Obtain APY |

|---|---|---|---|---|

Checking Accounts | Central Interest/Business Interest/Business 250 Interest Checking | 0.05% | 0.050% | $1.00 |

Checking Accounts | Platinum Checking | 0.10% | 0.100% | $50,000 |

Checking Accounts | Platinum Checking | 0.05% | 0.050% | $10,000 |

Checking Accounts | Platinum Checking | 0.05% | 0.050% | $1.00 |

Health Savings Account | Health Savings Accounts | 0.05% | 0.050% | $1.00 |

Savings Accounts | Savings Accounts | 0.05% | 0.050% | $1.00 |

Money Market Accounts | Money Market/Money Market Plus | 0.05% | 0.050% | $2,500 or > (>$1 for MM+) |

Money Market Accounts | Money Market/Money Market Plus | 0.05% | 0.050% | $2,499 or < (N/A for MM+) |

Central Money Market | Personal | 0.05% | 0.050% | < $10,000 |

Central Money Market | Personal | 0.05% | 0.050% | $10,000 to $49,999 |

Central Money Market | Personal | 0.05% | 0.050% | $50,000 to $99,999 |

Central Money Market | Personal | 0.10% | 0.100% | $100,000 to $249,999 |

Central Money Market | Personal | 0.15% | 0.150% | $250,000 or > |

Central Money Market | Nonpersonal | 0.05% | 0.050% | < $10,000 |

Central Money Market | Nonpersonal | 0.05% | 0.050% | $10,000 to $49,999 |

Central Money Market | Nonpersonal | 0.05% | 0.050% | $50,000 to $99,999 |

Central Money Market | Nonpersonal | 0.05% | 0.050% | $100,000 to $249,999 |

Central Money Market | Nonpersonal | 0.05% | 0.050% | $250,000 or > |

Certificate of Deposit | 7 to 31 Days | 0.05% | 0.050% | $20,000 |

Certificate of Deposit | 32 to 89 Days | 0.05% | 0.050% | $5,000 |

Certificate of Deposit | 90 to 179 Days | 0.10% | 0.100% | $2,500 |

Certificate of Deposit | 180 to 364 Days | 0.15% | 0.150% | $1,000 |

Certificate of Deposit | 1 Year | 0.15% | 0.150% | $500 |

Certificate of Deposit | 2 Years | 0.20% | 0.200% | $500 |

Certificate of Deposit | 3 Years | 0.30% | 0.300% | $500 |

Certificate of Deposit | 4 Years | 0.40% | 0.399% | $500 |

Certificate of Deposit | 5 Years | 0.50% | 0.499% | $500 |

Current CD Specials | Central Advantage (1 year – individuals only) | 0.10% | 0.100% | $2,500 |

Current CD Specials | CD Management Account (1 year – variable rate) | 0.05% | 0.045% | $2,500 |

Individual Retirement Accounts | Variable Rate – 18 Months | 0.15% | 0.150% | $100 |

Individual Retirement Accounts | Fixed Rate – 6 Months | 0.15% | 0.150% | $500 |

Individual Retirement Accounts | Fixed Rate – 12 Months | 0.15% | 0.150% | $500 |

Individual Retirement Accounts | Fixed Rate – 24 Months | 0.20% | 0.200% | $500 |

Individual Retirement Accounts | Fixed Rate – 36 Months | 0.30% | 0.300% | $500 |

Individual Retirement Accounts | Fixed Rate – 60 Months | 0.50% | 0.499% | $500 |